The smart Trick of Kam Financial & Realty, Inc. That Nobody is Talking About

The smart Trick of Kam Financial & Realty, Inc. That Nobody is Talking About

Blog Article

How Kam Financial & Realty, Inc. can Save You Time, Stress, and Money.

Table of ContentsThe Definitive Guide for Kam Financial & Realty, Inc.The Greatest Guide To Kam Financial & Realty, Inc.Kam Financial & Realty, Inc. for DummiesKam Financial & Realty, Inc. Fundamentals ExplainedThe Definitive Guide to Kam Financial & Realty, Inc.10 Easy Facts About Kam Financial & Realty, Inc. Explained

When one considers that home loan brokers are not needed to submit SARs, the actual quantity of home mortgage fraudulence activity could be much greater. (https://dzone.com/users/5250420/kamfnnclr1ty.html). Since very early March 2007, the Federal Bureau of Investigation (FBI) had 1,036 pending home mortgage fraud examinations,4 compared to 818 and 721, specifically, in the 2 previous yearsThe mass of home loan fraud drops right into 2 broad groups based on the motivation behind the scams. commonly entails a borrower who will overstate earnings or possession values on his/her financial statement to receive a finance to purchase a home (mortgage broker in california). In a lot of these instances, expectations are that if the earnings does not rise to satisfy the payment, the home will be cost an earnings from gratitude

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)

More About Kam Financial & Realty, Inc.

The large majority of fraud circumstances are discovered and reported by the organizations themselves. According to a research study by BasePoint Analytics LLC, broker-facilitated fraudulence has actually emerged as the most widespread sector of mortgage scams nationwide.7 Broker-facilitated home mortgage scams occurs when a broker materially misstates, misstates, or omits details that a car loan police officer counts on to make the decision to extend credit.8 Broker-facilitated fraudulence can be scams for residential or commercial property, scams commercial, or a mix of both.

A $165 million neighborhood financial institution made a decision to go into the mortgage banking company. The financial institution purchased a little home loan business and hired a seasoned home loan banker to run the procedure.

The 5-Second Trick For Kam Financial & Realty, Inc.

The financial institution informed its key federal regulatory authority, which then got in touch with the FDIC due to the possible influence on the bank's monetary condition ((https://pagespeed.web.dev/analysis/https-www-ghwickser-com/dlsby2bhkc?form_factor=mobile). Additional investigation disclosed that the broker was working in collusion with a contractor and an appraiser to turn properties over and over once again for greater, invalid revenues. In total, greater than 100 lendings were stemmed to one builder in the same class

The broker refused to make the settlements, and the instance went right into lawsuits. The financial institution was eventually awarded $3.5 million. In a succeeding discussion with FDIC inspectors, the bank's president suggested that he had actually constantly listened to that the most challenging part of home loan banking was making certain you carried out the right hedge to counter any rate of interest price take the chance of the financial institution could sustain while warehousing a substantial quantity of home loan.

The Kam Financial & Realty, Inc. Ideas

The financial institution had representation and service warranty clauses in agreements with its brokers and thought it had recourse relative to the car loans being originated and marketed through the pipeline. Throughout the lawsuits, the third-party broker argued that the bank ought to share some obligation for this exposure because its internal control systems need to have acknowledged a car loan concentration to this community and set up actions to hinder this threat.

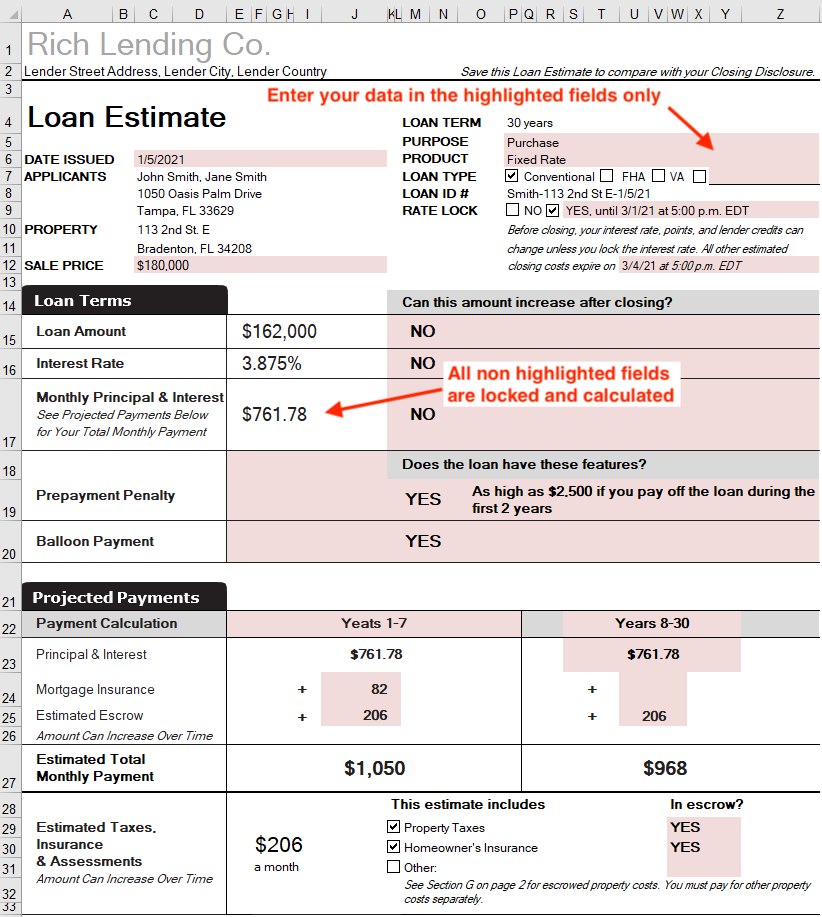

What we call a monthly home mortgage payment isn't just paying off your mortgage. Instead, think of a monthly home mortgage payment as the 4 horsemen: Principal, Rate Of Interest, Residential Or Commercial Property Tax Obligation, and Property owner's Insurance policy (called PITIlike pity, because, you recognize, it raises your settlement).

Hang onif you think principal is the only amount to consider, you 'd be forgetting about principal's ideal pal: rate of interest. It 'd behave to think loan providers allow you obtain their money even if they like you. While that might be real, they're still running an organization and desire to put food on the table too.

More About Kam Financial & Realty, Inc.

Rate of interest is a percent of the principalthe quantity of the lending you have actually delegated pay off. Rate of interest is a portion of the principalthe quantity of the finance you have actually left to repay. Home mortgage rate of interest are frequently transforming, which is why it's clever to choose a home mortgage with a set rate of interest so you know just how much you'll pay every month.

That would certainly indicate you would certainly pay a massive $533 on your very first month's home loan payment. Obtain all set for a little bit of math right here.

Indicators on Kam Financial & Realty, Inc. You Should Know

That would make your regular monthly home loan repayment $1,184 each month. Monthly Principal $1,184 $533 $651 The following month, you'll pay the very same $1,184, but less will certainly go to passion ($531) and extra will certainly most likely to your principal ($653). That fad continues over the life of your home mortgage till, by the end of your mortgage, almost all of your repayment goes toward principal.

Report this page